(773) 763-6750

< prevnext >

(This archived article was published in 2014. More recent data is found in the articles section of our web site). There is no universally accepted practice for the treatment of replacement reserves and leasing expenses (tenant improvements (TIs) and commissions) in the income statement developed by commercial property appraisers as a basis for estimating value using direct capitalization. While it is often the case that these are capital items, falling below the NOI (net operating income) line, which is capitalized into a value estimate, such costs may still have a sizeable effect on value and should not be ignored. Additionally, it is not always the case that these are capital expenses and so would be properly included as an operating expense in the commercial appraiser's reconstructed operating statement . The Dictionary of Real Estate Appraisal defines net operating income (NOI) as the actual or anticipated net income that remains after all operating expenses are deducted from effective gross income but before mortgage debt service and book depreciation are deducted.[1] It equates to the definition to EBITDA (earnings before interest, taxes, depreciation, and amortization) used in corporate finance and business valuation. EBITDA does not include capital expenses, which are monies meant to acquire or improve an asset, e.g., land, buildings, building additions, site improvements, machinery, equipment; as distinguished from cash outflows for expense items that are normally considered part of the current period's operations. Such costs depreciated over the asset's useful life. Repairs, even significant ones, that do not extend the asset's life, however, are treated as routine operating expenses and so are reflected in NOI. This is where things begin to get fuzzy from an appraisal perspective. How are items such as reserves for replacement, tenant improvements and leasing commissions properly handled? Do such expenditures extend the life of the asset making it a "below the line" capital expenditure or do they merely return the asset back to its previous condition making it an "above the line" expense? Does it matter? Let's address the last question first. Yes, it may matter very much depending on how the capitalization rate used to convert net income to value was derived. In the PwC Real Estate Investor Survey, PricewaterhouseCoopers (PwC) LLP, describes three methods by which investors capitalize income:

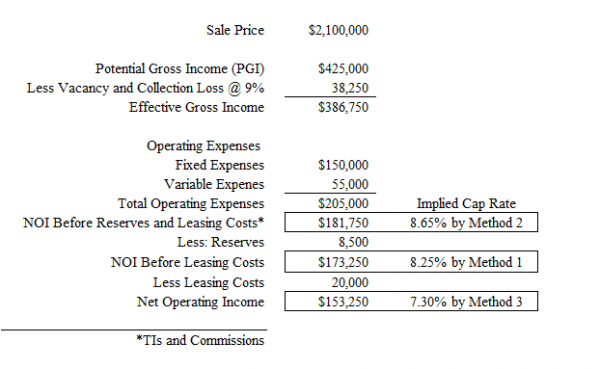

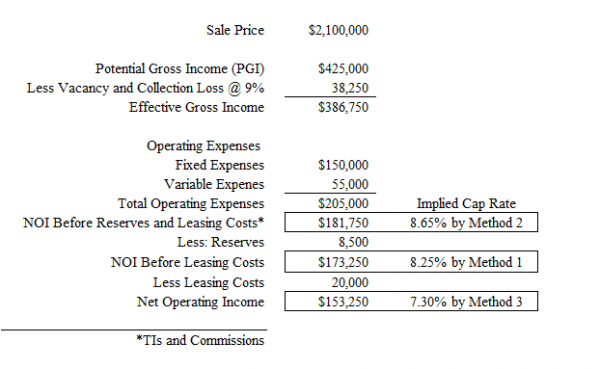

(This archived article was published in 2014. More recent data is found in the articles section of our web site). There is no universally accepted practice for the treatment of replacement reserves and leasing expenses (tenant improvements (TIs) and commissions) in the income statement developed by commercial property appraisers as a basis for estimating value using direct capitalization. While it is often the case that these are capital items, falling below the NOI (net operating income) line, which is capitalized into a value estimate, such costs may still have a sizeable effect on value and should not be ignored. Additionally, it is not always the case that these are capital expenses and so would be properly included as an operating expense in the commercial appraiser's reconstructed operating statement . The Dictionary of Real Estate Appraisal defines net operating income (NOI) as the actual or anticipated net income that remains after all operating expenses are deducted from effective gross income but before mortgage debt service and book depreciation are deducted.[1] It equates to the definition to EBITDA (earnings before interest, taxes, depreciation, and amortization) used in corporate finance and business valuation. EBITDA does not include capital expenses, which are monies meant to acquire or improve an asset, e.g., land, buildings, building additions, site improvements, machinery, equipment; as distinguished from cash outflows for expense items that are normally considered part of the current period's operations. Such costs depreciated over the asset's useful life. Repairs, even significant ones, that do not extend the asset's life, however, are treated as routine operating expenses and so are reflected in NOI. This is where things begin to get fuzzy from an appraisal perspective. How are items such as reserves for replacement, tenant improvements and leasing commissions properly handled? Do such expenditures extend the life of the asset making it a "below the line" capital expenditure or do they merely return the asset back to its previous condition making it an "above the line" expense? Does it matter? Let's address the last question first. Yes, it may matter very much depending on how the capitalization rate used to convert net income to value was derived. In the PwC Real Estate Investor Survey, PricewaterhouseCoopers (PwC) LLP, describes three methods by which investors capitalize income: Depending on which level of income is capitalized, this transaction produces at least three different capitalization rates. There is a common misconception that each property or property type has a single unique cap rate, but this is incorrect. In fact any number of cap rates can be extracted from a single sale depending given the host variations possible for the computation of income: e.g. whether it is projected income or trailing income that is capitalized; whether or not the income is stabilized; whether it is contract rent or market rent that is capitalized; whether or not adjustments for vacancy and collection losses are considered; or what level of income is capitalized. Cap rates vary by geography, with property age, based on the strength of tenants, length and terms of leases, with market conditions and interest rates. Applying a capitalization rate suitable to one method of computing income to the wrong income stream produces a spurious result. In the example above applying the cap rate extracted from the this sale using Method 3 (cash flow after reserves and leasing expenses) to a subject’s NOI before reserves and leasing expenses would result in an over valuation by more than 18%— $2,490,000 (roundly) vs. $2,100,000. So which method is right? Since 80% of investors use Method 2, capitalizing NOI before reserves, TIs, and leasing commissions, shouldn’t that be the method commercial property appraisers use? No, not necessarily. This isn’t the type of situation where “majority rules.” There are good reasons for applying any one of the three methods. For example, appraisers almost routinely consider replacement reserves in their reconstructed income statements, which equates to Method 1. This is because the direct capitalization method is premised on the assumption that the single year’s stabilized income reflects its potential earnings, now and in perpetuity. Therefore, an allowance for replacements is charged against NOI on the premise that periodic replacements have to be made of short-lived items such as water heaters, heating units, roofs, paving, parking lots, landscaping, exterior finishes, etc., to maintain the optimum rental status of the property and to reduce the escalation of maintenance and other operating expenses that may result from the deferral of necessary capital expenditures.

Depending on which level of income is capitalized, this transaction produces at least three different capitalization rates. There is a common misconception that each property or property type has a single unique cap rate, but this is incorrect. In fact any number of cap rates can be extracted from a single sale depending given the host variations possible for the computation of income: e.g. whether it is projected income or trailing income that is capitalized; whether or not the income is stabilized; whether it is contract rent or market rent that is capitalized; whether or not adjustments for vacancy and collection losses are considered; or what level of income is capitalized. Cap rates vary by geography, with property age, based on the strength of tenants, length and terms of leases, with market conditions and interest rates. Applying a capitalization rate suitable to one method of computing income to the wrong income stream produces a spurious result. In the example above applying the cap rate extracted from the this sale using Method 3 (cash flow after reserves and leasing expenses) to a subject’s NOI before reserves and leasing expenses would result in an over valuation by more than 18%— $2,490,000 (roundly) vs. $2,100,000. So which method is right? Since 80% of investors use Method 2, capitalizing NOI before reserves, TIs, and leasing commissions, shouldn’t that be the method commercial property appraisers use? No, not necessarily. This isn’t the type of situation where “majority rules.” There are good reasons for applying any one of the three methods. For example, appraisers almost routinely consider replacement reserves in their reconstructed income statements, which equates to Method 1. This is because the direct capitalization method is premised on the assumption that the single year’s stabilized income reflects its potential earnings, now and in perpetuity. Therefore, an allowance for replacements is charged against NOI on the premise that periodic replacements have to be made of short-lived items such as water heaters, heating units, roofs, paving, parking lots, landscaping, exterior finishes, etc., to maintain the optimum rental status of the property and to reduce the escalation of maintenance and other operating expenses that may result from the deferral of necessary capital expenditures.

Leasing Expenses: Above the Line or Below the Line Expenses and Does It Matter - Part 1

Article: (This archived article was published in 2014. More recent data is found in the articles section of our web site). There is no universally accepted practice for the treatment of replacement reserves and leasing expenses (tenant improvements (TIs) and commissions) in the income statement developed by commercial property appraisers as a basis for estimating value using direct capitalization. While it is often the case that these are capital items, falling below the NOI (net operating income) line, which is capitalized into a value estimate, such costs may still have a sizeable effect on value and should not be ignored. Additionally, it is not always the case that these are capital expenses and so would be properly included as an operating expense in the commercial appraiser's reconstructed operating statement . The Dictionary of Real Estate Appraisal defines net operating income (NOI) as the actual or anticipated net income that remains after all operating expenses are deducted from effective gross income but before mortgage debt service and book depreciation are deducted.[1] It equates to the definition to EBITDA (earnings before interest, taxes, depreciation, and amortization) used in corporate finance and business valuation. EBITDA does not include capital expenses, which are monies meant to acquire or improve an asset, e.g., land, buildings, building additions, site improvements, machinery, equipment; as distinguished from cash outflows for expense items that are normally considered part of the current period's operations. Such costs depreciated over the asset's useful life. Repairs, even significant ones, that do not extend the asset's life, however, are treated as routine operating expenses and so are reflected in NOI. This is where things begin to get fuzzy from an appraisal perspective. How are items such as reserves for replacement, tenant improvements and leasing commissions properly handled? Do such expenditures extend the life of the asset making it a "below the line" capital expenditure or do they merely return the asset back to its previous condition making it an "above the line" expense? Does it matter? Let's address the last question first. Yes, it may matter very much depending on how the capitalization rate used to convert net income to value was derived. In the PwC Real Estate Investor Survey, PricewaterhouseCoopers (PwC) LLP, describes three methods by which investors capitalize income:

(This archived article was published in 2014. More recent data is found in the articles section of our web site). There is no universally accepted practice for the treatment of replacement reserves and leasing expenses (tenant improvements (TIs) and commissions) in the income statement developed by commercial property appraisers as a basis for estimating value using direct capitalization. While it is often the case that these are capital items, falling below the NOI (net operating income) line, which is capitalized into a value estimate, such costs may still have a sizeable effect on value and should not be ignored. Additionally, it is not always the case that these are capital expenses and so would be properly included as an operating expense in the commercial appraiser's reconstructed operating statement . The Dictionary of Real Estate Appraisal defines net operating income (NOI) as the actual or anticipated net income that remains after all operating expenses are deducted from effective gross income but before mortgage debt service and book depreciation are deducted.[1] It equates to the definition to EBITDA (earnings before interest, taxes, depreciation, and amortization) used in corporate finance and business valuation. EBITDA does not include capital expenses, which are monies meant to acquire or improve an asset, e.g., land, buildings, building additions, site improvements, machinery, equipment; as distinguished from cash outflows for expense items that are normally considered part of the current period's operations. Such costs depreciated over the asset's useful life. Repairs, even significant ones, that do not extend the asset's life, however, are treated as routine operating expenses and so are reflected in NOI. This is where things begin to get fuzzy from an appraisal perspective. How are items such as reserves for replacement, tenant improvements and leasing commissions properly handled? Do such expenditures extend the life of the asset making it a "below the line" capital expenditure or do they merely return the asset back to its previous condition making it an "above the line" expense? Does it matter? Let's address the last question first. Yes, it may matter very much depending on how the capitalization rate used to convert net income to value was derived. In the PwC Real Estate Investor Survey, PricewaterhouseCoopers (PwC) LLP, describes three methods by which investors capitalize income:- Method 1: NOI after deducting capital replacement reserve but before deducting TIs (tenant improvements) and leasing commissions.

- Method 2: NOI before deducting capital replacement reserve, TIs, and leasing commissions.

- Method 3: Cash flow after deducting capital replacement reserve, TIs, and leasing commissions.

In preparing a reconstructed operating statement for a typical year, an appraiser recognizes that replacements must be made eventually and that replacement costs affect operating expenses. These costs can be reflected in increased annual maintenance costs or, on an accrual basis, in an annual replacement allowance.[2]Nevertheless, it is vitally important for commercial real estate appraisers relying on surveys to be cognizant of the fact that 80% of the respondents to the latest PwC survey reported capitalization rates for strip centers before reserves. Applying such a rate to income after reserves would tend to undervalue a property—in the hypothetical example cited above by almost $100,000, roughly 5%. OK. So what about leasing expenses (tenant improvements (TIs) and leasing commissions)? Aren’t these below the line items? Wouldn’t it be incorrect to consider them in computing income to be capitalized? Yes, leasing expenses may be below the line items; but not always, and no it is not inappropriate for a commercial appraiser to consider them in income to be capitalized. That leasing expenses are below the line expenses seems plenty clear, at least at first blush. After all the Appraisal Institute defines a below the line expense as:

…an expense that is recorded below the net operating income line in a reconstructed operating statement and therefore not considered part of the total operating expenses for the property; tenant improvements and leasing concessions are the most common line items recorded below the net operating income line.[3]But are they always a below the line? No. The classification of the expenses should be dependent on whether they are made to acquire, expand or extend the life of the property, in which case they would be capital expenses and tallied below the line. This would be true in the case of a recently built office building its lease up stage, in which commissions are paid to secure new tenants and the space is built out to accommodate the tenant’s needs. However, when there is build out and commissions to retain tenants, or to secure tenants to replace departing tenants, such expenses, which may be anticipated to occur on an ongoing basis, would properly be considered part of operations, and hence could be an above the line expense. Tenant improvements (TIs) are the costs for building out retrofitting all or part of an office, industrial or retail building for tenant occupancy, and may include such items as painting, carpeting, space partitioning, carpentry, light fixtures, restroom renovations, and other interior finishes. A tenant improvement allowance may be provided by a property owner as an inducement (or concession) to secure a lease. The allowance is a negotiable item that impacts the effective rent achieved by the property. There is often an inverse relationship between the demand for space and the amount of the tenant improvement allowance, so that impact on cash flow available for debt service will vary with time and the strength of the market. In addition to TIs, the owner may also have to pay a leasing commission to the broker of the leasing transaction. Lenders and commercial real estate appraisers are well aware that commercial property assets periodically require spending to maintain the property’s physical quality and to lease space to new tenants so that reserve accounts may be used to set aside such funds when the loan is originated and periodically during the loan term. From a lending standpoint, the cash flow that is underwritten is often the NOI less the cost of capital improvements necessary to maintain the property in its current condition and, for commercial properties, the cost of re‐tenanting space at lease expiration. An underwriter typically calculates all costs estimated to lease vacant and re‐lease expiring space for office, retail and industrial properties based on the anticipated lease rollover schedule over the term of the loan. We may also reiterate that in the PwC survey, 10% of investors in strip centers reportedly do capitalize cash flow after deducting capital replacement reserve, TIs, and leasing commissions. Quoting from The Appraisal of Real Estate:

The net income to be capitalized may be estimated before or after an annual allowance for specific replacement categories, e.g. the allowance for furniture, fixtures and equipment for hotel properties and the replacement allowance for office properties. Again, it is imperative that the appraiser analyze comparable sales and derive their capitalization rates in the same manner used to analyze the subject property and capitalize its income.[4]Similar arguments may be made for the explicit consideration of TIs and commissions in some fashion in the income statement. In The Appraisal of Real Estate the Appraisal Institute cautions:

Extensive tenant improvements can influence contract rent or they may be built into the asking rent as a tenant improvement allowance. Consideration of tenant improvements (TIs) is usually addressed in yield capitalization and discounted cash flow analysis because the costs accrued can be incorporated into the analysis at the appropriate points of the projection period. Ignoring the impact of TIs in direct capitalization may be a mistake. Stabilized net operating income should recognize the tenant improvements made to a property that are appropriate for the market [5]So while the Appraisal Institute does give tenant improvements and leasing concessions as examples of below the line expenses, The Appraisal of Real Estate also shows leasing commissions as an example of a variable operating expense.[6] It also shows a replacement allowance as an above the line item in examples of reconstructed operating statements and in cash flow analyses found in the text.[7] In his article “The Elusive Definitions of NOI and OAR,” John M. Francis, MAI observes that, “TIs fall within the set of building components for which replacement reserves are appropriate…”[8] He continues to discuss how The Appraisal of Real Estate is somewhat vague and even inconsistent concerning the treatment of leasing expenses He reasons:

While the textbook refers to other valid calculations of appropriate income figures to capitalize, one can conclude that, based on the foregoing analysis and other things being equal, an appraiser’s preferred method of calculating NOI that is to be capitalized could be stated as: net income after consideration of all fixed and variable expenses (including stabilized leasing commissions) and reserves for replacements (including stabilized allowances for tenant improvements) [9]In essence, Method 3. An older (12th) edition of The Appraisal of Real Estate, suggests two approaches to dealing with TIs depending on the age and timing of the improvements:

Furthermore, tenant improvements on a new building are usually capital expenditures while TIs in an existing space being retenanted are usually an expense. When TIs occur during the economic lifespan of a building dictates how they are treated and impact NOI – i.e., if they directly impact NOI and are recorded above the NOI line item in a reconstructed operating statement, they are considered above-the-line expenses, while at other times they are below the line.[10]This view was espoused in the 2004 New York Supreme Court decision in the Matter of Reckson Operating Partnership v Assessor of Town of Greenburgh (2004 NY Slip Op 50153(U) Decided on March 19, 2004 Supreme Court, Westchester County Published by New York State Law Reporting Bureau pursuant to Judiciary Law 431) which found that:

Tenant improvement costs are a recognized expense for space being re-tenanted in a building that, like the subject property, is well into its economic life span. On a stabilized basis over the course of an investment an owner would recognize the need to fund tenant work and meet these expenditures when they arise…[11]The decision went on to note that:

In the context of ordinary turnover in a multi-tenant office building such as 555 White Plains Road, courts have recognized tenant-installation costs as an ongoing expense to be deducted from income as part of the capitalization process.[12]Mr. Francis remarks that, “The principal justification for considering reserves for replacements and leasing commissions… is that doing so leads to a more accurate measurement of yield.”

The reality is that the vast majority of investors amortize the costs of short-lived building components, including tenant improvements and leasing commissions, over the lives of their respective leases. They do not depreciate them over the remaining life to the building.[13]The author concludes, “Each of the methods for developing NOI can be the most appropriate, depending on the appraisal assignment.”[14] So far we’ve pointed out that data from a single property transaction can produce multiple cap rates (i.e. that one size does not fit all) and secondly, that applying a cap rate derived form a comparable sale or survey using income calculated in one manner to the income for an appraisal subject that is calculated using another method produces erroneous results. A third item to note is that as one moves down the income ladder in the hypothetical example above, the capitalization rate gets smaller. Obviously, as more expenses are taken out, income declines and so does the cap rate. Also true, is that a cap rate is a measure of risk, or uncertainty. Assuming the accuracy of the data, as the specificity of the income model increases, uncertainty is diminished and the cap rate falls. So there may be a real advantage in explicitly considering the impact of such below the line expenses as leasing expenses. After all, the risk profile of property where half of the tenants have leases that expire within the next 12 months is much different than one having leases expiring two or three years out. Just because leasing expenses fall below the line from an accountancy perspective, these potential costs cannot be ignored in an appraisal. The buyer of such a property would certainly be well of aware of these forthcoming expenses in his purchasing decision and will plan accordingly. The argument for commercial appraisers for capitalizing income before reserves generally follows from accounting definitions that these are capital costs and not operating expenses. In point of fact however, as Francis observes, the majority of investors amortize short-lived building components, including leasing expenses (TIs and leasing commissions) over the lives of the underlying leases and do not depreciate them over the life of the building. As much as anything else, the practice of capitalizing income before reserves is a marketing stratagem to make the property appear more attractive because both the NOI and cap rate are higher; nevertheless, as Francis also points out in his article, sophisticated investors are well aware of these costs. Even in corporate finance and business valuation, practitioners warn against exclusive reliance on EDITDA as a performance measure and value indicator. Warren Buffet is famously reported to have asked, “Does management think the tooth fairy pays for capital expenditures?”[15] Endnotes: [1] Appraisal Institute, The Dictionary of Real Estate Appraisal, 5th ed. (Chicag Appraisal Institute, 2010). [2] Appraisal Institute, The Appraisal of Real Estate 13th ed. Chicag2008, p.492 [3] Idem p. 480. [4] Idem p.503 [5] Idem p.480 [6] Idem p.486 [7] Idem p.496, 543 [8] Francis, John M., MAI “The Elusive Definitions of NOI and OAR” The Appraisal Journal, January 1998 pp. 56-61. [9] Idem [10] Appraisal Institute, The Appraisal of Real Estate 12th ed. Chicag 2001 pp. 508-9 [11] Matter of Reckson Operating Partnership v Assessor of Town of Greenburgh, 2004 NY Slip Op 50153(U) Decided on March 19, 2004 Supreme Court, Westchester County Published by New York State Law Reporting Bureau pursuant to Judiciary Law 431. [12] Idem [13] Francis, John M., MAI “The Elusive Definitions of NOI and OAR” [14] Idem [15] Gavin, Ted, CTP.“Five Reasons Why EBITDA is a Big Lie.” Forbes. 12/28/2011