Office Capitalization Rates Go Hemispheric!

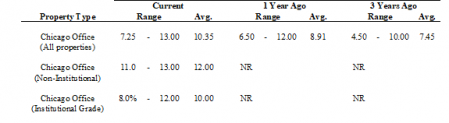

Chicago office market capitalization rates appear to be increasing dramatically. Three years ago, PwC’s Investor Survey reported average overall Chicago market office capitalization rates at 7.45%. One year ago, office capitalization rates were at 8.91%. In the fourth quarter of 2024, capitalization rates have jumped to 10.35%! What is even more dramatic is results reflecting the break-out between Institutional Grade and Non-Institutional Grade office buildings. The Average 4Q 2024 Institutional Grade capitalization rate was 10.0% while the Non-Institutional Grade capitalization rate was a whopping 12%.

PWC CHICAGO OFFICE MARKET INVESTOR SURVEY CAP RATES 4th QUARTER 2024

We have not seen capitalization rates this high in over a decade. It is important to note that this only reflects the office market and other property types have much lower capitalization rates.

PwC’s 4th Quarter 2024 Survey also reported investor expectations for Chicago office market values over the next twelve months which ranged from going up 5% to declining as much as 25% with an average of 8.3% decline in value projected. This reflects the highly negative prospects most investors see for the office market.

We suspect part of the increase in capitalization rates is the result of office building owner financial exhaustion and capitulation as they simply cannot afford to continue holding on to unprofitable office properties. Banks are also increasingly reluctant to continue renewing loans on buildings that are underwater.

As people are simply not used to seeing this high capitalization rate, we think it is important to show the three-year trend and that this data source was reporting a capitalization rate of 8.91% as recently as last year.

We would be remiss if we did not point out that RERC reports a lower office capitalization rate. For the most part, they report Midwest Region data as opposed to Chicago. For first-tier properties, however, they break out Chicago and report Central Business District Office capitalization rates at 7.1% and first-tier suburban rates at 7.9%. Keep in mind, however, that PwC does report a 2% spread between Institutional and Non-Intuitional properties.

RERC REAL ESTATE REPORT 4th QUARTER 2024